Recommend capping cesses, surcharges at 5% of gross tax revenue: CM to Finance Commission

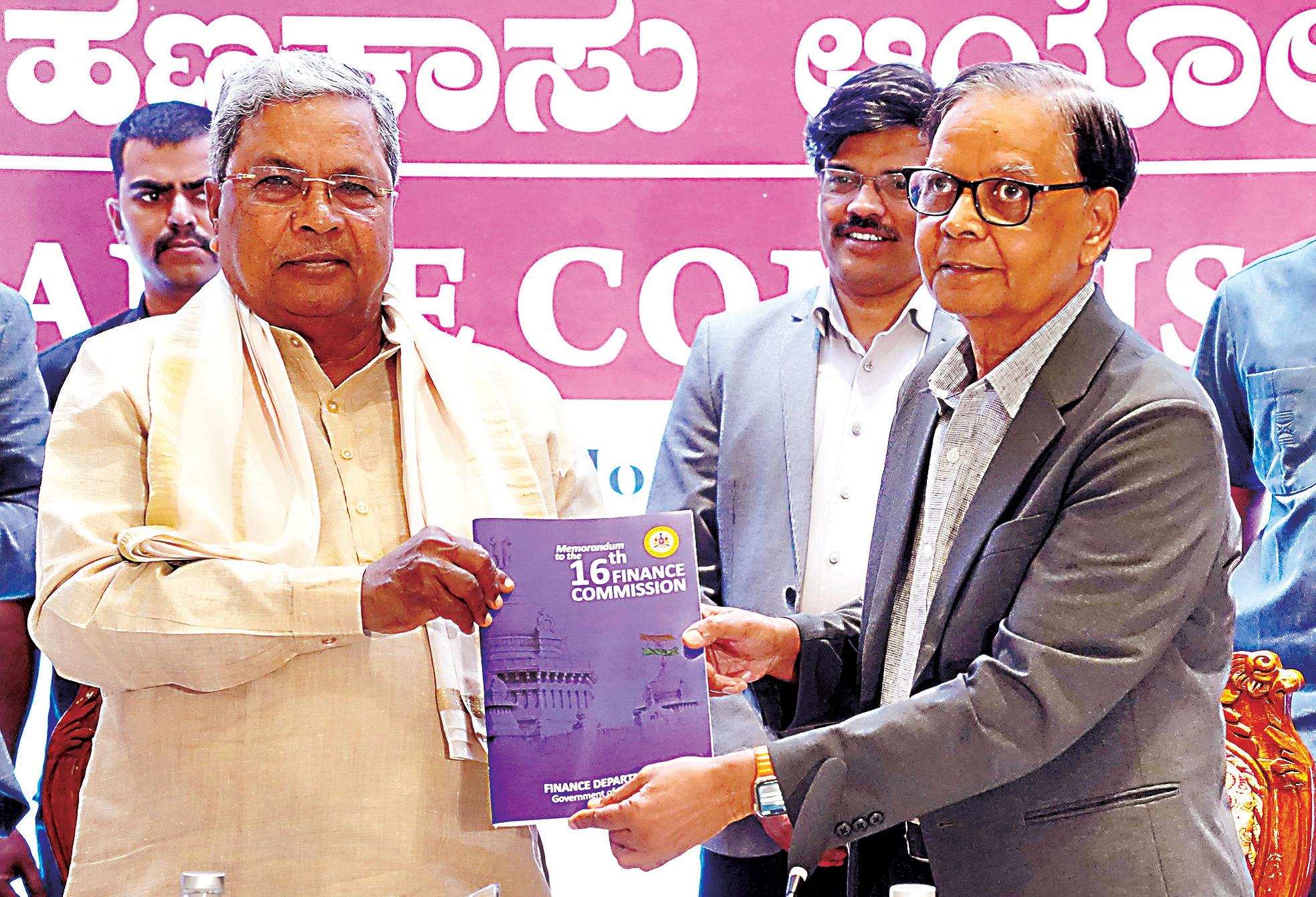

Bengaluru, NT Bureau: Karnataka Chief Minister Siddaramaiah on Thursday requested the 16th Finance Commission to recommend capping of cesses and surcharges at five per cent of gross tax revenue, and anything exceeding that should be a part of the divisible pool.

In his address to Chairman of the 16th Finance Commission Arvind Panagariya and its members at a meeting here, he also requested the panel to recommend that vertical devolution should be at least 50 per cent of the divisible pool.

All non-tax revenues of the Centre should be included in the divisible pool of taxes by bringing the necessary Constitutional amendment, Siddaramaiah said.

The Chief Minister said economically advanced States are committed to supporting poorer States, but this should not come at the expense of their own residents or economic efficiency.

The Commission needs to carefully examine the impact of extremely high emphasis given to equity on the incentives of well performing states.

"Moreover, the taxpayers of such states expect their taxes to work for them. This creates public trust. The Finance Commission therefore needs to do a tightrope walk while balancing equity with efficiency and performance", Siddaramaiah said.

Due to the disproportionate weightage given to equity by the 15th Finance Commission, Karnataka and similarly placed States ended up getting penalised for their good performance, both fiscally and demographically, the Chief Minister said.

Noting that cesses and surcharges are not part of the divisible pool, the Chief Minister said over the years, the Union Government has increased its reliance on them. This has led to the divisible pool not growing in the same proportion as the Gross Tax Revenue, he said.

This has caused substantial loss to all the States. The loss to Karnataka on account of the non-sharing of cesses and surcharges from the divisible pool is Rs. 53,359 crore during the period 2017-18 to 2024-25, according to him.

English daily published in Bengaluru & Doha

English daily published in Bengaluru & Doha