Residential Demand on a 6-yr High

NT Correspondent

Bengaluru: Residential demand in Q3- 2023 (July-September 2023) trended up significantly to 82,612 units, 12 per cent higher in year-onyear (YoY) terms and 7 per cent higher compared to the preceding quarter, says the India Real Estate Report for the Third quarter of the year by Knight Frank, global property consultancy.

The report said the growth is noteworthy as it constitutes an almost sixyear high in quarterly sales volumes. Sales traction was higher across all markets in YoY terms.

Among the larger markets, the NCR stood out with a 27% growth in sales during the quarter. Kolkata was the market with the highest growth at 105% YoY, largely due to a pronounced base effect caused by the market transitioning into the RERA environment during Q3-2022.

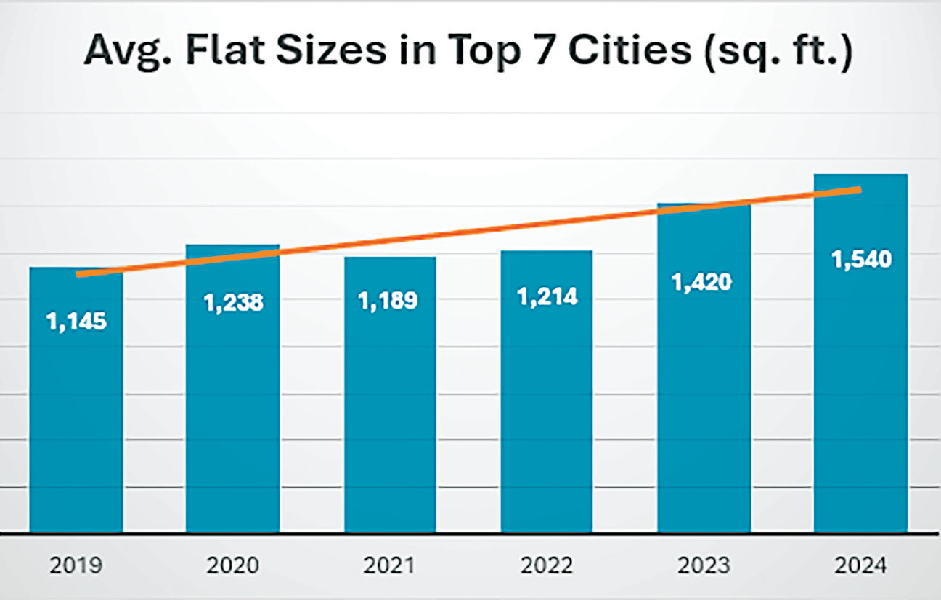

Sales volumes in Pune grew by 20% YoY while the rest of the markets experienced steady single digit growth during the quarter. The Report further said, "Consistent with the upward trend seen in the past seven quarters, the share of sales in the Rs. 10 mn and above ticket-size grew significantly to 35% in Q3-2023 compared to 28% a year ago. This can be attributed to the homebuyers’ need to upgrade to larger living spaces with better amenities".

The share of home sales in the Rs. 5-10 mn category remained steady at 36% in Q3- 2023. The share of the Rs. 5 mn and below ticketsize, however, deteriorated from 36% in Q3-2022 to 29% in Q3-2023, as increasing prices, home loan rates and the comparatively adverse impact of the pandemic on homebuyers in this segment continued to weigh on demand.

In another first, the midsize and premium segments each constituted a larger slice of the sales pie than the Rs. 5 mn and below category. Supply levels at 85,549 units were significantly elevated compared to sales, 23% higher in YoY terms during Q3 2023, as developers continued to capitalize on the steady homebuyer demand and consistently launched new projects to match the contemporary needs of the homebuyers.

Sales traction was higher across all markets in YoY terms. Price levels have also grown in tandem with demand across all markets in YoY terms. Price levels in Hyderabad saw the most significant rise at 11% YoY as focus increasingly shifts toward the development of premium high-rise.

Bengaluru recorded 13 , 3 5 3 launches during the Q3 - 2023 while recording sale o f 13, 169 units during the quarter.

Slowdown in Office Market The report noted that almost all office markets around the world are bearing the brunt of the slowdown in economic growth and the still persistent phenomenon of remote working which took root during the pandemic.

While the Indian economy has not been completely insulated from the economic turbulence, timely interventions by the Central Bank and the Government have ensured that inflation has not spiraled out of control and the economy has stayed on the growth path.

India has emerged as the fastest growing large economy in the world with the GDP growing at 7.2% YoY in FY 2023, and the RBI’s estimate of a 6.5% growth for FY 2024 is expected to ensure that it continues to remain in a bright spot in a still uncertain global economic environment.

This undercurrent of economic stability and growth is also reflected in the relatively strong occupier activity seen in the Indian office market. B.luru Witnesses a Pause The 16.1 mn.sq.ft. area transacted during Q3 2023 represents a healthy 17% YoY growth.

With a transacted volume of 3.2 mn.sq. ft., Mumbai was the most active market during Q3- 2023 and accounted for 20% of the total area transacted during the period.

Notably, Mumbai, along with Pune, reached their highest quarterly transacted volumes since 2018, at 3.2 mn.sq.ft and 3 mn.sq.ft. respectively. While all the larger markets saw a growth in transacted volumes, demand in the Bengaluru market took a pause after a relatively strong showing in the first two quarters of the year.

In Q3-2023, 2.1 mn.sq. ft area was transacted in Bengaluru, translating to a YoY drop of 59%. The Hyderabad market also scaled a near three-year high in terms of quarterly transacted volumes on the back of the long-awaited supply which came online during the quarter. 2.9 mn.sq.ft of office space was transacted in the Hyderabad market during Q3- 2023.

English daily published in Bengaluru & Doha

English daily published in Bengaluru & Doha