Modi's silence on market crash fuels investor concerns

NT Correspondent

Bengaluru: Prime Minister Narendra Modi’s silence on the share market crash has been met with disappointment. India's benchmark indexes logged their worst day in around five months on February 28, with Nifty 50 posting its longest monthly losing streak since 1996 on pessimism over domestic market conditions. The BSE Sensex fell more than 1,400 points, or 1.9%, on Friday, a dramatic intensification of the slide in stock values seen since February 4.

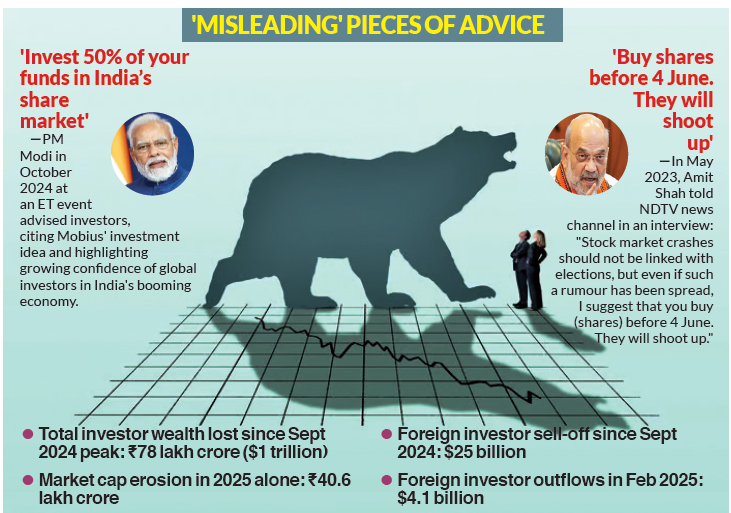

Since that date, the Sensex has fallen from levels of 78,500 to 73,000. The index has shed 6.7% this year so far. Estimates suggest investors lost Rs 9 lakh crore in a single day. In fact, the stock market has been in the bears’ grip for 13 of 14 consecutive days. Notably, the Nifty 50 had touched a high of 26,277 points on September 26, 2024. The BSE Sensex had been at 85,978 points on the same date. Mutual fund investors have lost money in almost all sectoral and thematic funds in the last six months, an analysis of the performance of the category showed. Moreover, PM Modi and Union Home Minister Amit Shah had boasted of the confidence of the global investor in the Indian market in the lead up to last year’s Lok Sabha elections. Remarkably, Modi has continued deploying the same narrative at the Bhopal Global Investors’ Meet and hasn’t even addressed the stock market crash.

He cited remarks by the World Bank, a representative of the Organisation for Economic Co-operation and Development (OECD), among others to make his point. Indian stocks' worst run in 29 years eroding nearly 85 trillion rupees (nearly $1 trillion) in investor wealth, according to Reuters. In June 2024, Opposition leader Rahul Gandhi demanded a parliamentary investigation into sharp stock market moves towards the end of the just-ended national elections, alleging that Modi gave misleading investment advice. Projections made 2024 General elections exit polls sent stock markets surging the next trading day with the NSE Nifty 50 and S&P BSE Sensex jumping 3.3 percent and 3.4 percent, respectively, a day before the Election Commission declared the results.

Modi and some of his ministers had said during campaigning that the markets would surge when results were declared on June 4 with Home Minister Amit Shah saying in a television interview, “Buy before June 4. They will shoot up.” Stock markets, however, crashed to a four-year low on Tuesday – down nearly 6 percent – after election results showed Modi’s BJP lost its outright majority in the Lok Sabha, the lower house of parliament, and the BJP-led NDA won a narrow majority to give Modi a third term. Foreign investors have sold $25 billion worth of Indian equities since the end of September, with $4.1 billion exiting in February alone.

What explains the crash? The downturn is triggered by a number of international factors and some domestic ones. Economic experts said US President Donald Trump’s penchant for tariff wars has had an inescapable effect on global markets. Trump imposed 25 per cent tariffs on European aluminium and steel.

This triggered fears that similar tariffs may be imposed on gold, causing banks like JP Morgan and HSBC to move much of their gold reserves from London to New York. An estimated two per cent of gold in London’s vault has been emptied. Moreover, a strong dollar attracts capital to the US markets as investors taking comfort in stability.

On the Indian front, poor short-term evaluations and sluggish corporate earnings and the fact that India trades at premium rates has made global investors opt for other emerging markets like South Korea, Taiwan and Indonesia in the short-term.

Exodus to China: Much of this can also be traced back to September 2024, when China announced a number of policies, mainly stimulus packages to consolidate growth rate at five per cent in 2024 and 2025. This had a salutary effect on Chinese stock markets. The Hang Seng index shot up 18.7 per cent in a month as Nifty sank 1.55 per cent, prompting a “Sell India, Buy China” trend among investors.

It is to be noted that Foreign Institutional Investors (FIIs) buy Chinese stocks through the Hong Kong market. In fact, the Indian stock market has bled $1 trillion since October 2024 as Chinese stock markets gained twice as much.

English daily published in Bengaluru & Doha

English daily published in Bengaluru & Doha